If you’re in the market for a phone plan, there’s something you should be aware of. A phone plan is a type of credit. Therefore, the answer to the question “do phone plans affect your credit score?” is yes. Tippla has outlined how and why your phone plan influences your credit rating below.

What is a phone plan?

A phone plan (also referred to as a post-paid plan) is a contract where you get a phone, as well as voice, SMS and data inclusions for a single price. With a plan, you don’t have to pay for the phone outright, instead, you pay a monthly fee at the end of the month which includes the cost of the phone as well as your usage. If you take on a phone plan, you don’t own the phone until you’ve paid it off.

Postpaid vs prepaid: what’s the difference?

Postpaid and prepaid are the two main types of phone deals you can have in Australia. The main difference between postpaid and prepaid is when you pay for the service. As we mentioned above, with a postpaid phone plan, you pay at the end of the month and pay based on your usage.

With a prepaid plan, however, you pay at the beginning of each month. Typically with a prepaid plan, you pay a fixed monthly amount for pre-determined parameters, such as your monthly data, text and phone calls.

In addition, with a prepaid plan, you generally need to already own the phone you use. Whereas with a postpaid plan, the phone often comes with the plan and can be used as a way of buying the phone you want without having to pay the full amount upfront.

Why would you get a postpaid phone plan?

There are a number of reasons why you might want to get a postpaid phone plan. The main reason would be if you want to buy a new phone, but you don’t want to pay for it outright. Taking on a phone plan can allow you to purchase a new phone and pay it off in instalments, as well as cover your phone and data usage.

With a prepaid plan, you pay a fixed amount each month and as a result, you get a set amount of inclusions: data, texts and calls. If you exceed your set inclusions, then you will need to recharge your phone again.

With a postpaid plan, however, because you’re not paying your bill until the end of the month, you can exceed your plan’s limitations. Whilst you will have to pay for the extra usage, you don’t have to worry about not being able to use your phone if you do go over.

Who offer phone plans in Australia?

In Australia there are three mobile networks – Telstra, Optus and Vodafone, also referred to as telecommunication companies (or telcos). Whilst these three networks do offer wide coverage, the quality of the coverage will depend on where you live and what mobile communications standard your phone can connect to (3G, 4G or 5G). This is especially true for regional and rural areas.

In terms of who offers phone plans, there are many telcos in Australia that offer phone plans. Telstra, Optus and Vodafone all offer their own phone plans based on their networks and these guys are the big three telcos in Australia. However, there are many smaller telcos that offer a range of plans, but they’re all based on one of the three networks.

In fact, in Australia, you can get a phone plan from your supermarket, with Coles, Woolworths and Aldi all offering their own phone plans. But there are a range of other providers such as dodo, iinet, Moose, TeleChoice – the list goes on and on.

That’s why it’s a good idea to know what network will offer you the best coverage based on your location and needs. Once you’ve determined this, you can shop around for a phone plan that meets your usage needs, such as the amount of data you want, texts and phone call limits.

There are a number of comparison sites that have compiled many of the phone plans on offer. However, they don’t necessarily show all of the options out there. That’s why it’s good to shop around online.

How do phone plans affect your credit score?

Now let’s tackle the next question – how do phone plans affect your credit score? Just like a loan or credit card, a postpaid phone plan is considered to be a line of credit. A prepaid phone plan is not a line of credit as you’re paying for the service upfront.

1. Telcos will typically check your credit score

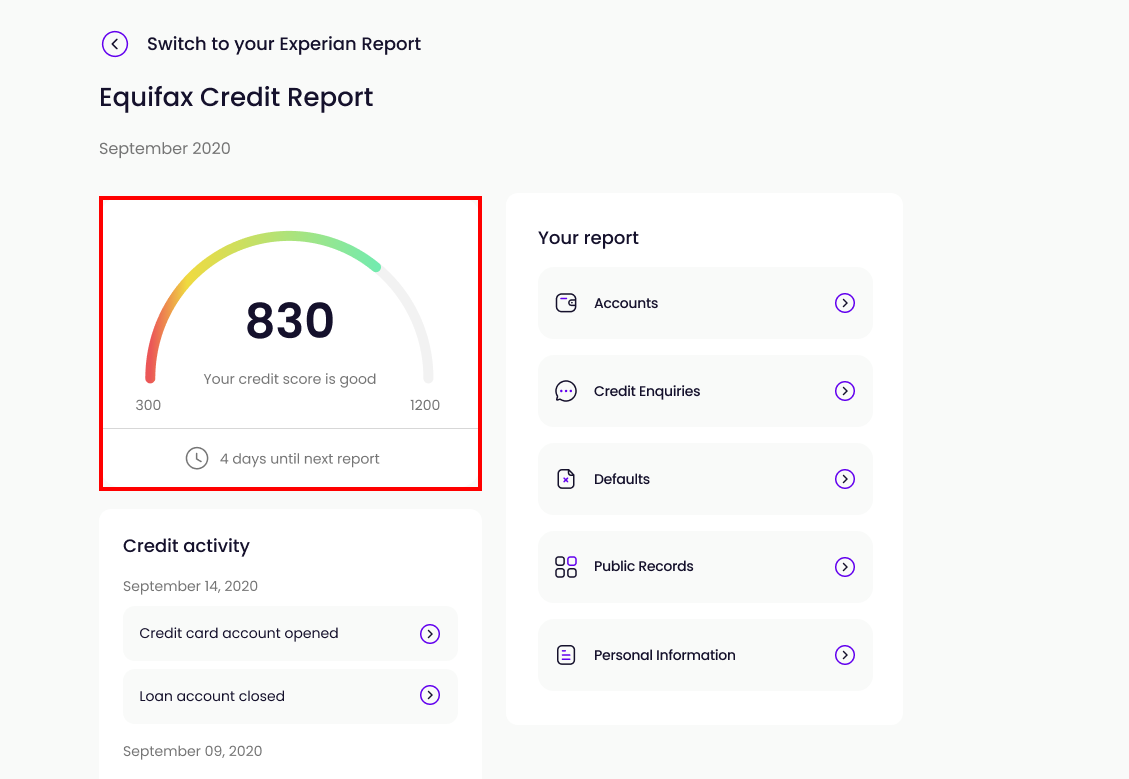

What does this mean? When you apply for a postpaid phone plan, the telco company you apply with will typically check your credit score, to see how reliable of a borrower you are. This check is known as a hard enquiry, and it will harm your credit score initially.

Regardless of whether you are approved for the phone plan, the hard enquiry will remain on your credit report for five years, as a credit enquiry (credit application). This means, for the next five years, any time you apply for a loan or some kind of credit, the companies you apply with will be able to see this credit enquiry on your report.

2. If you miss your repayments, it could harm your credit score

Going forward, if your application for the phone plan is accepted, then this will be listed as an active credit account on your report. If you default on your phone plan repayments, then this will also appear on your credit report. Initially, this will also harm your credit score. Furthermore, the default will remain on your credit report for up to five years, and any time you apply for credit, the company you’re applying with will see the default.

3. It can help you build a good credit history

On the reverse, a phone plan can help you build a good credit history and boost your credit score. If you can make all of your repayments on time, then this can go a long way to show that you are responsible with your finances.

The trick here is to remain on top of your repayments. Therefore, it’s a good idea to make sure you can comfortably afford your phone plan repayments before you apply.

Can you prevent your phone plan from impacting your credit score?

The short answer to this is yes, there are a number of things you can do to stop a phone plan from impacting your credit score.

1. Opt for a prepaid phone plan

Instead of getting a postpaid phone plan, you can instead get a prepaid plan. Nowadays, prepaid plans can offer really good deals, such as unlimited text and calls and large data limits.

If you take a prepaid phone plan, the company you buy it from won’t perform a credit check and because you pay for the service in advance, if you miss a payment, it won’t harm your credit score.

However, if you take out a prepaid phone plan, then you will need to pay for your phone outright or use the existing phone you’ve already paid for. So whilst a prepaid phone plan won’t impact your credit score, it isn’t always a suitable option.

2. Always make your repayments on time

As we highlighted above, if you take on a postpaid phone plan, if you default on a monthly repayment, then this will appear on your credit report. Not only will it harm your credit score, but it will also serve as a black mark on your report for up to five years.

In order to avoid this, it’s important to make your repayments on time. If you consistently make your repayments, then this can actually be good for your credit score and show that you are a reliable borrower.

3. Try not to exceed your plan limitations

In line with making your repayments on time, one way you can help yourself out with this is by making sure you don’t exceed the plan’s limitations. If you go over your data usage then your provider might give you extra data as a top-up automatically and charge you for the extra data – even if you don’t use it all. This is sometimes called an add on.

When you get close to having used all of your data, you will likely receive a text or an email from your provider, however, these can be easy to miss. Whilst one top-up might not cost much, if you end up needing several top-ups, it can get costly.

That’s why it’s a good idea to keep an eye on your usage as you go through the month and try not to exceed your limitations. You can also speak with your provider on whether you can disable automatic top-ups.