If you are looking for extra finance, whether it’s to make a big purchase, cover unexpected expenses, or build a credit history, there are two main options available for you – a credit card or personal loan. These two types of credit are very popular in Australia, but we’re here to break down the difference between credit cards and personal loans, so you can choose what’s best for you.

What is a credit card?

Before we jump into the difference between credit cards and personal loans, let’s start with the basics – what is a credit card? Literally speaking, a credit card is a piece of plastic or metal that is issued by a bank or financial services company.

You can use a credit card to pay for goods and services, as well as any personal expenses that may arise. A credit card is a line of credit that you can use to pay for personal or business expenses on the promise that you repay the money back, often with interest. Your credit card is a revolving line of credit, which means it refreshes after a certain period of time – typically each month, and it will continue to do so up until you cancel the card.

Because a credit card is a line of credit, this means you don’t need to have the money physically in your bank account, as is the case with a debit card. This is where credit cards and personal loans are similar.

Different types of credit cards

In Australia, there are many different types of credit cards. Whilst the basics stay the same, the different types of credit cards all come with their unique purposes and benefits. Here’s a quick overview of the different options available to you.

| Low-interest credit cards | As the name suggests, a low-interest credit card is a credit card that offers a lower interest rate than normal. Many credit cards charge 20% or more on purchases, whereas low interest-rate credit cards generally have an interest rate that’s 14% or lower. These cards can also come with no interest periods, typically up to 55 days. However, low-interest credit cards can generally come with more restrictions, fewer rewards and a higher annual fee. |

| Balance transfer credit cards | A balance transfer credit card is when you transfer your outstanding debt from one credit card to your balance transfer credit card. The balance transfer credit card usually has a low interest rate or sometimes even a 0% interest rate for a limited time.

This allows you to repay your existing debt, and try and repay your new debt with the balance transfer credit card within the interest-free or low-interest period, which can save you money. However, if you can’t repay it within this period, then it might cost you more in the long run. |

| No annual fee credit card | Most credit cards come with an annual fee that you have to pay each year across the life of your credit card. A no annual fee credit card is a type of credit card where you don’t have to pay this fee.

There are two main types of no annual fee credit cards – the first is where you don’t have to pay an annual fee during the whole life of the credit card, the second is where you don’t have to pay an annual fee during an introductory period, which usually lasts for 1 or 2 years. |

| Rewards credit card | Rewards credit cards give you some kind of reward, usually in the form of points, every time you make a purchase. There are many different types of rewards cards, and the points can be used for things like – retail rewards, supermarket rewards, cashback deals, frequent flyer points and petrol rewards.

Whilst these cards can give you bonuses, they don’t come for free. Generally speaking, rewards cards often come with higher annual fees and it can take a while for the points to build up (and they can expire). So, it’s important to read the terms and conditions carefully and weigh up the pros and cons. |

| Cashback credit card | With cashback credit cards, you can get cashback when you make purchases. This can come in the form of a cash voucher or money credited back to your account. However, as with all types of credit cards – when there are perks, that generally means higher fees.

In this instance, cashback credit cards often come with higher interest rates and an annual fee. Some cards can also cap how many cashback points you can earn. |

| Frequent flyer credit card | A frequent flyer credit card is a common type of rewards credit card, and it’s great for those who love to travel. When you spend on your frequent flyer credit card, you’ll accrue points. When you build up enough points you can put them towards flights and either get cheaper flights or have the whole cost covered by points – depending on how many you have.

The downsides to this type of credit card are that the frequent flyer points can expire. These types of credit cards also generally come with standard credit cards fees such as – annual fee, program fee, cash advance fee and more. |

| Platinum or black credit card | Platinum or black credit cards are high-end credit cards. You can get a number of benefits with these cards – exclusive dining and travel deals, as well as rewards points that don’t expire. If you’re over 18 and earn more than $50,000 each year, have a good credit score, then you can apply for one of these credit cards.

Some of the drawbacks of a platinum credit card include much higher annual fees and interest rates. |

What is a personal loan?

Similar to a credit card, a personal loan is a line of credit that allows you to pay for personal expenses – whatever they may be. A personal loan allows you to borrow a specific amount of money under the agreement that you pay it back within a predetermined time period, referred to as the loan term, with interest.

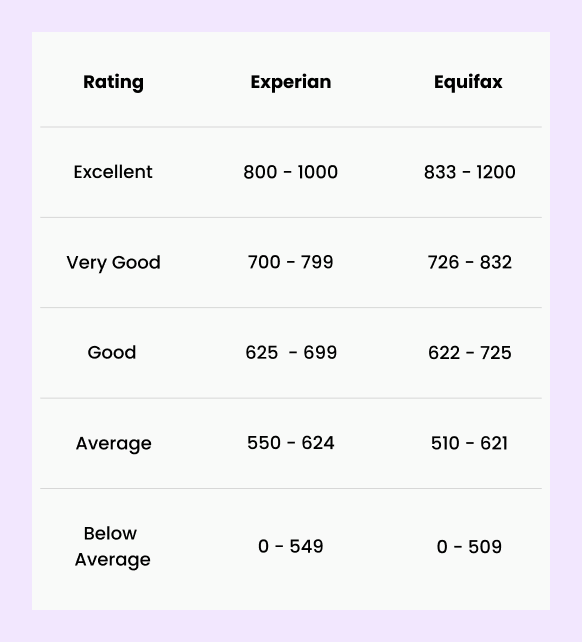

The interest rate you are charged will depend on a couple of factors, including your credit score. Want to see where you’re at? Check your credit score with Tippla here.

When taking on a personal loan, you can get a loan with a fixed or variable interest rate. You can also choose between a secured or unsecured personal loan.

Different types of personal loans

There are a couple of different types of personal loans. Here is a breakdown below.

Secured and unsecured personal loans

The two main types of personal loans are secured and unsecured personal loans. A secured personal loan is when you take on a personal loan that is guaranteed by an asset such as a car. This asset is used as security against you defaulting on your loan. If you default on your repayments and can’t afford to repay the loan, then you are at risk of losing your asset.

Secured personal loans are generally used to purchase the security you’re using against the loan. Let’s break that down. Say you want a loan to buy a car, then the car you buy will be the security on the loan.

One of the benefits of a secured loan is that you can generally get lower interest rates. Interest rates are set to protect the lender against the risk of you defaulting on your loan. Because your asset serves as collateral, the lender can afford to offer you lower interest rates, because they have already hedged against the risk of you defaulting on your loan.

Unsecured personal loans, on the other hand, is a personal loan that you don’t have to provide any security for. Reasons for taking out an unsecured personal loan range from holiday expenses, home improvements, unexpected expenses, medical bills and more.

Because there’s no security against the loan, the interest rates are generally higher for unsecured loans. But on the plus sign, the application and approval process is usually quicker.

Fixed or variable interest rate personal loans

When it comes to interest rates on personal loans, the most common are either fixed-rate or variable-rate loans. Here’s what that means. A fixed-rate personal loan is when the interest stays the same for the whole loan term.

One of the perks of this is it allows you to easily budget for your repayments, as they stay the same each month. However, a downside of this is you could miss out on your interest rate being reduced if interest rates go down. On the flip side, if interest rates go up, then you’re protected with a fixed-rate personal loan.

Variable-rate personal loans are when the interest you’re charged each month isn’t the same, and it can fluctuate depending on the market. Some of the pros of this type of loan include – fewer repayments because you can make earlier repayments and pay off your loan sooner, more flexibility and potentially lower interest rates.

Although there are some positives to choosing this type of loan, there are still some things to consider. Namely, you might end up having to pay more in interest if the interest rate rises. This can cost you in the long run.

What’s the difference between credit cards and personal loans?

Whilst there are many similarities between a credit card and a personal loan, there are also some differences. So what is the difference between credit cards and personal loans? Here are the main points:

Borrowing amount

When you are approved for a personal loan, you will be given a set amount of money in a lump sum at the beginning of the loan term. You can’t spend more than the amount you have been given unless you take out an additional loan. With a credit card, the borrowing limit refreshes each month, so your borrowing limit is more flexible than a personal loan.

Length of term

Personal loans generally come with a fixed term, whether it be a couple of months or years, and they come with a termination date. Credit cards, on the other hand, are a revolving line of credit and refresh each month. For most credit cards, you can have them for as long as you want – whether that’s a month, years, or even decades. The length of time is determined by you as the customer.

Interest rates

Personal loans generally have lower interest rates than credit cards. According to the Reserve Bank of Australia (RBA), the average variable interest rate for a personal loan as of September 2020 was 14.41% and 12.42% for a fixed personal loan. Whereas the average credit card interest rate ranges from 16-18%, according to numerous comparison sites. However, you can avoid paying interest on your credit card if you pay off the card balance in full each month.

Rewards

Although credit cards might have higher interest rates, they generally come with more rewards and perks. As we covered above, sometimes you might end up paying more for these perks, but if you use them wisely, you can make them work for you.

What’s the right decision for me?

Now you know the difference between credit cards and personal loans, you might now be thinking about what’s the best choice for you. At the end of the day, only you know your financial situation. However, there are a couple of things you can consider when choosing between a credit card or a personal loan.

Firstly, if you have control over your spending and can follow a budget, then a credit card might meet your needs. Whereas if you’re looking to make a big one-off purchase or pay for an expense, a personal loan might be better for you.

If you’re unsure, you can speak to a free financial counsellor who can help you make the best decision for your personal situation.