Introduction

Unfortunately, mistakes in your credit report are quite common. Oftentimes, these mistakes can harm your credit score or create further issues that can result in you being rejected for credit.

In this lesson, we’re going to take you through the steps you can take to repair your credit report if there are mistakes. Here’s exactly what we’re going to cover:

- How common are mistakes on your credit report?

- What are the most common mistakes found on credit reports?

- Why are mistakes so common on your credit report?

- How to repair your credit report if there are mistakes

How common are mistakes on your credit report?

First, we’re going to take a look at how common are mistakes on your credit report. Unfortunately, they are quite common – 1 in 5 credit reports have some kind of mistake on them.

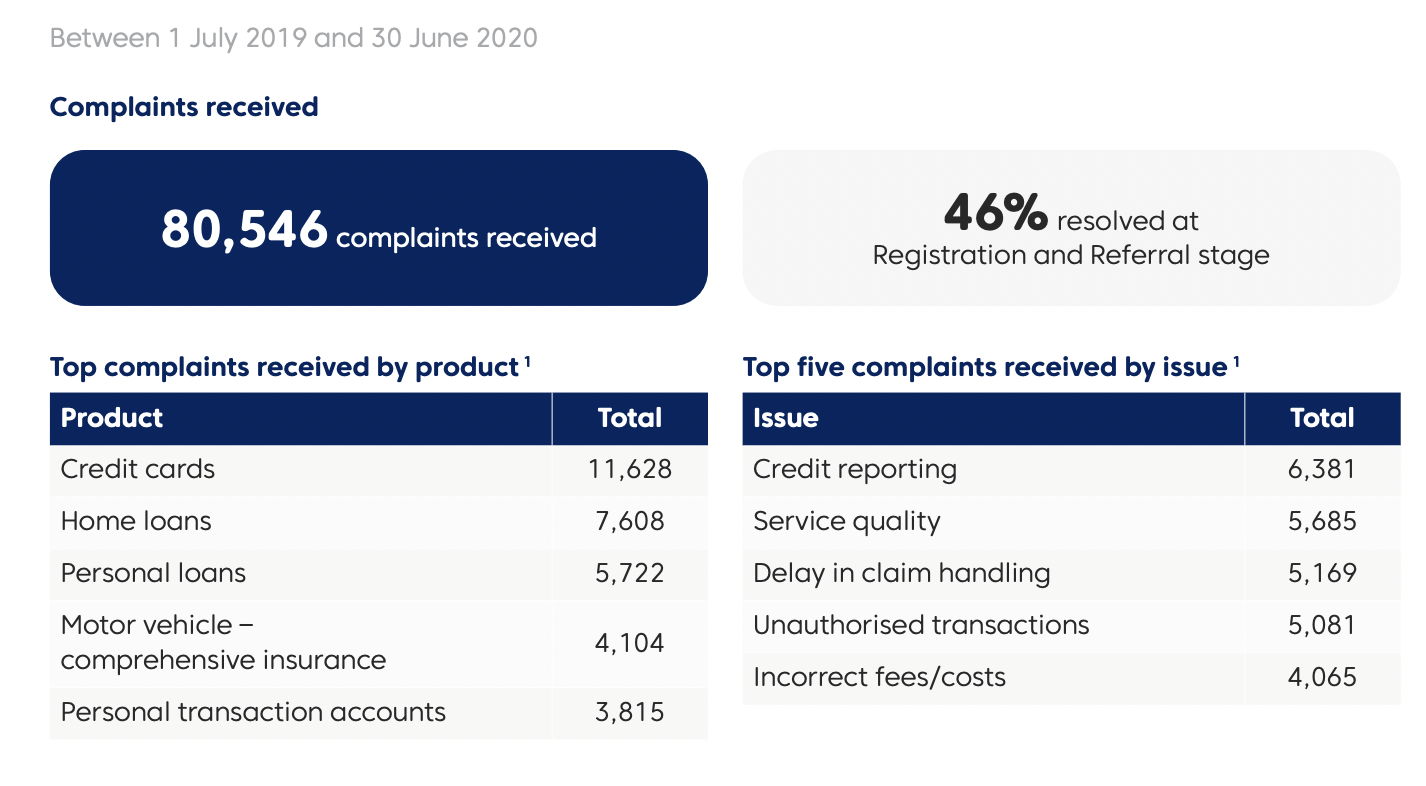

As of November 2018, the Australian Financial Complaints Authority (AFCA) handles all credit-related complaints. We can gauge from AFCA’s 2019-20 annual review just how prevalent complaints are within the credit space.

Specifically, AFCA’s report outlined that credit providers received 9,857 complaints between the 1st of July 2019 and the 30th of June 2020. Debt collectors or buyers received 2,607 complaints during the period.

Credit cards were the most complained about product, with 11,628 complaints received during the period. Credit reporting topped the list for complaints received by issue. Specifically, 6,381 complaints were lodged.

AFCA highlights in its report: “There was also an increase in the average number of complaints received per month about credit reporting (up 34%), unauthorised transactions (up 14%) and responsible lending (up 14%). An increase in credit reporting complaints was partly driven by a rise in consumer awareness about credit scores and increased refinancing activity towards the end of the year.

“There was an increase in complaints about disputed transactions in recent months due to the impact of the COVID-19 pandemic. These mainly related to consumers seeking chargebacks for services purchased before the pandemic that were impacted by COVID-19, such as travel and accommodation.”

So what does this mean? To put it simply – mistakes are very common on your credit report, and consumer awareness is driving a large uptick in the number of complaints received by AFCA.

What are the most common mistakes found on credit reports?

Now you have an idea of how prevalent mistakes on your credit report can be, let’s take a look at what are the most common mistakes you should be looking out for.

To help us with this, we reached out to Chinelle Wardle, the Director of Wardle Consultancy Services Pty Ltd. Wardle Consultancy Services specialises in helping Aussies (and/or their representatives) improve their credit scores themselves, without having to pay thousands of dollars in fees to credit repair companies.

1. Personal information

Wardle outlined that the most common mistake on credit reports is personal information. Specifically, Wardle highlighted that 9 out of 10 credit reports from her clients had some kind of mistake with the personal information. We highlighted why personal information is so important in the first module of this lesson.

2. Credit enquiries

The second most common mistake Wardle has found among her clients are issues with credit enquiries. “A lot of my clients come to me wanting to dispute credit enquiries on their report,” Wardle explained to Tippla.

“This is because many Australians aren’t aware that when they apply for any type of credit – even a phone plan – that this will appear on their credit report as an enquiry and may harm their credit score. This is because, whilst credit providers will tell their customers they will perform a credit check, they’re not letting their customers know about the implications of a credit check.”

Wardle also outlined that there are often mistakes in the enquiries listed on credit reports. Oftentimes, the amount of credit applied for will be incorrect.

“Customers often come to me asking why they have a credit enquiry for $5,000, for example, when they only applied for a loan of $1,000,” Wardle continued. “So it’s not just that consumers don’t realise credit enquiries will appear on their report and harm their score, credit providers commonly get the information wrong.”

3. Repayment history

With the introduction of Comprehensive Credit Reporting (CCR), the repayment history of your credit accounts is also reported to the credit bureaus. This is so a mixture of positive and negative credit information appears on your credit report.

However, Wardle has seen quite often that this positive data isn’t reported to credit bureaus. Therefore, Australians aren’t benefiting from their positive credit behaviour, as the information isn’t making its way to their reports.

Furthermore, Wardle has found that late repayments also known as defaulted payments are commonly listed on credit reports incorrectly. She has seen frequent examples of when a customer has come to an agreement with their creditor to delay payment (and a new date has been agreed upon), the missed payment will still be listed as a late repayment on their report, even though an agreement has been made.

Why are mistakes so common on your credit report?

There are two sides to this answer. When it comes to defaults being listed incorrectly, repayment history not being reported, and similar issues, then this is a creditor error. These can be caused by insufficient internal processes, communication issues and human error.

Sometimes, the mistake can be consumer error – a general lack of awareness, making mistakes on credit applications, and forgetting to update creditors when your personal information changes can all contribute to mistakes on your credit report.

This is why it’s important that you check your credit report frequently to ensure that all the information is correct, including your personal information. Not only can incorrect information harm your credit score, but it can also result in you being rejected for credit.

How to repair mistakes on your credit report

Now that you’ve noticed there’s a mistake on your credit report – what steps should you take to repair your credit score? According to Wardle, the first thing you should do is call the credit provider in question to try and resolve the issue.

Specifically, Wardle advises that you raise a complaint with your creditor about the incorrect information. Then, if it isn’t resolved, you can seek for it to be escalated further both internally within the creditor’s complaints area, and if necessary, escalate it externally with an ombudsman such as AFCA or an external agency such as the credit bureau that holds this information.

However, according to Wardle, the credit bureaus can typically help you update the personal information on your credit report, but when it comes to defaults and similar issues, they will refer you back to your creditor.

It is also possible for you to use a credit repair company, but Wardle cautions that these companies can be very expensive and cost you thousands of dollars. If you have the financial means and don’t have time to fix the issues yourself, then you can opt for a credit repair company.

However, Wardle emphasises that you can repair your credit yourself if you have the right tools and can dedicate the time needed to discuss your issues with the relevant parties involved.