“Your future is created by what you do today, not tomorrow!”

Robert Kiyosaki

Tippla is a tool that helps Australians to access and understand their credit scores. We are not financial advisors. We work with a range of industry professionals and compliance check our content to ensure factual accuracy. We do not provide professional financial advice. Consider seeking independent legal, financial, taxation or other advice to check how the information in this lesson relates to your unique circumstances.

Introduction

If you are after finance, the number of options on the market can be quite overwhelming! Especially when you don’t know exactly what you need just yet. You could save yourself time and protect your credit score by doing your research upfront. Each time you apply for credit, the credit provider, which can be a bank, lender, utility provider or financial institution will pull a hard enquiry that will be listed on your credit report and may cause your credit score to drop.

When applying for credit, your potential credit provider will enquire about your credit score and can see if there have been too many enquiries too close to each other. To a credit provider, it may look like all these other financial institutions have rejected you and, therefore, they may be more likely to reject your application. To be safe, know your options before you dive deep into the world of credit.

In this lesson you will learn:

- Which types of credit you may need – and when;

- What credit scores do you need to get credit;

- What to look for when comparing credit providers.

Different types of credit

Once you start looking into getting finance, you may notice that there are multiple options available, each of which would help you achieve your goal. Take some time to get to know what types of finance you’re likely to encounter so you can make an informed choice before applying.

Here are a few things to look at when choosing the most suitable loan option for you:

- Availability

What credit options are actually available to you? Each credit provider has its own set of criteria, therefore, your personal situation, current finances and credit score may affect what sort of credit is currently available to you. - Costs

What loan or credit type has the lowest interest rate for the loan term you are interested in? Have you considered monthly, establishment or early termination fees? - Turnaround time

Sometimes, the unexpected happens and you’re left needing to pay for a bill straight away. If you can’t wait for the best finance option, you may want to look at a credit provider that can offer a fast loan. Remember to check the rates as this may be more expensive over the term of the loan. - Credit score

Depending on your credit score, you may have more or fewer options available to you. If you aren’t in a rush, it could make sense to wait a few months while working on improving your credit score. However, sometimes pressing matters can’t wait and you may have to go with what you’ve got. Credit providers may be able to approve a loan despite a poor credit record, based on how you currently make and spend money. They may also be able to offer a secured loan if you have an asset that can be tied to the loan.

Mortgages

A mortgage is a form of personal loan that is secured against the property you buy with it. A bank, lender or credit union will approve a loan with set repayments plus interest over a longer period of time. Home loans are usually set for 30 years. Getting a mortgage is a pretty big deal as it comes with big financial commitments. If you stop making your mortgage repayments at some point, the credit provider can repossess your property. However, if you pay them over the set amount of time, you become the happy owner of a paid-off property!

Fixed-rate mortgages

There are multiple types of mortgages. One of the most common types is a fixed-rate mortgage where the interest rate is fixed for a certain amount of time, usually 1 year. On the plus side, this allows you to budget better by knowing how much interest you will pay for the said period. It may be a good setup when you are a first home buyer or are investing in property. However, if your credit provider currently has a high interest rate in comparison to the market, chances are that you may miss out if rates drop again soon.

Additionally, fixed-rate mortgages often have limited features, meaning you may not be able to make extra payments during the time the interest is fixed.

Flexible rate mortgages

If your interest rate is flexible, it can constantly change over the lifetime of your mortgage. That means if your credit provider’s interest rate increases, your repayments will go up as well, if their rates drop, repayments will be lower, too. While your loan repayments will fluctuate a little more, this type of mortgage comes with additional features like extra repayments.

Things to consider: If you’re wanting to buy a house, for many people, a mortgage is the only way to do this. Whilst buying a house is exciting, there are things you should consider before committing yourself to a big loan.

Namely, mortgages are a long-term investment and your situation might change over time, which could lead to financial strain in the future. It’s good to make sure that you’re ready for such a long-term commitment. Another thing to be aware of – if you default on your mortgage you could lose your house.

Personal Loans

Personal loans come in many different forms and sizes. They are often easier to get than a mortgage but still require you to sign a loan agreement. Interest rates on personal loans vary, often depending on your credit score. Credit providers can offer special interest rates to people with a specifically good score as they are considered less risky borrowers.

Unsecured personal loans

Unsecured personal loans are usually the easiest type of loans to apply for, as they may require less paperwork. However, just because they can be easier and faster to apply for, that doesn’t necessarily mean that they’re easier to get. Unsecured personal loans are often for a smaller amount of money over a short period of time and typically come with a higher interest rate. Even if your credit rating is not great, you may be able to get an unsecured personal loan.

Secured Personal Loans

If you want to borrow larger amounts of money, a secured personal loan may allow you to do so. As the name suggests, you are required to provide an asset like a car, a boat, or a motorbike as security against your loan. How much you can take out may depend on the value of your asset. This type of loan can be used if you own a valuable asset already and don’t mind the idea of securing your repayments against it. The extra security may allow credit providers to offer bigger sums of money and lower interest rates. However, if you fail to make your repayments, you risk losing your asset.

Things to consider: whilst personal loans allow you to make larger purchases, cover unexpected expenses and build your credit history, it is worth considering if you can afford to take out a loan.

If you can’t afford the repayments of your personal loan, it could put you further into debt and negatively impact your credit score. If you have a bad credit score, then you could more likely only be offered loans with higher interest rates, meaning you could be paying more in the long term. It can also be damaging to your credit score if you apply to multiple credit providers for a loan in a short period of time.

Car Loans

Car loans are a specific form of personal loan for the purpose of buying a car. Often, this loan isn’t paid out directly to you. Instead, they can be paid to the dealership that you closed your car deal with.

In most cases, a car loan is secured against the car you are purchasing. This could help you to get a lower interest rate and better loan terms. However, if you can’t make your repayments, you are at risk of losing your car.

Things to consider: taking out a car loan is a convenient way to finance a car if you don’t have the cash on hand. Oftentimes, car loans can also be secured by the car, which means lower interest rates.

However, as with any credit, you should always make sure that you can afford the loan before taking it out. If your loan has been secured with your new car, if you default on your payments, then you might be at risk of losing your car.

Debt Consolidation Loan

If you have accumulated debt from multiple sources, you may consider consolidating your debt into one loan. Especially if you are struggling to keep up with multiple repayment dates, having it all in one place may be a good option for you. A debt consolidation loan combines all your current debts into one single debt with one interest rate and one repayment date. You may be able to get an overall better interest rate and save some money along the way.

Things to consider: consolidating your debt could make it more manageable as your repayments will be streamlined and you could potentially get an overall better interest rate. However, it is worth doing your research first.

Depending on your existing credit terms and conditions, consolidating your debt could actually mean that you are paying higher interest rates, which means you’ll end up paying more in the long term. You might also incur extra fees (establishment fees, fees for paying off your other debt early, etc).

Credit Cards (Lines of Credit)

Credit cards don’t have a specified loan term. Instead, they have a set borrowing limit and unpaid debt will roll over into the next payment period with added interest. Normally, you will have to make a minimum repayment towards your outstanding balance. Credit cards generally have a higher interest rate, however, if you pay your balance every month it won’t come with additional costs. There are multiple different types of credit cards, and they can each serve a different purpose.

Things to consider: Credit cards are the easiest and quickest ways to get a mini-loan. Nonetheless, there are some things for you to be aware of. It’s a good idea to use your credit card effectively. If you’re already struggling with managing your debt, then a credit card might not be your best option, as it could worsen your financial situation.

Credit cards often come with high interest rates, and if you can only make the minimum repayments, then your debt might grow. With all of this in mind, credit cards can come with perks and they can be a good way to build your credit score. So, before applying for a credit card, it is worth weighing up your options and determining whether a credit card is right for you. If you’re struggling with making a decision, you can contact a financial advisor who will be able to assist you in making an informed decision.

Student Loans

Student loans often come with low interest rates and could be considered an investment in your future. They often come with long loan terms and smaller repayment amounts over a longer time period.

Things to consider: student loans allow you to invest in your future value. However, taking on a loan shouldn’t put you under financial strain and a student loan can only be used for studying. You might want to make sure that you can afford the repayments before taking on the commitment.

Business Loans

A business loan is a form of loan given to help with business operations. This could be linked to a specific purchase or to provide cash flow in the first years of operation until the business is actually making a profit. Business loans are often big amounts of money linked to a business plan. They may be secured against assets or your business itself. However, it is often easier to get a business loan if you have been operating as a business for many years and proven to know what you are doing. Most credit providers request at least two years worth of financial history for their assessment. For new business owners, it could be tricky to get a business loan approved.

Things to consider: business loans could allow you to follow your dreams and start your own business or help you grow and expand your existing business. But, there are some things to watch out for – if your business hits difficult times, this could be made more difficult with having to meet your loan repayments. Also, if your business is new, then your loan might come with higher interest rates as credit providers may view you as more of a risk.

Furthermore, if a business loan has been secured by an asset – either from the owner or someone with a legitimate interest in the business, and you can’t make your repayments, then this could affect your personal finances and you could be at risk of losing the asset.

Home Equity Loans

Even while you are still paying for your home, you can make use of its value by taking on a so-called equity loan. The value of your property that you have already repaid can be used to take on new credit. Because it is secured against your property, home equity loans come with lower interest rates and provide good security to creditors.

Things to consider: You could use this loan for multiple situations – to invest in additional property and expand your investment portfolio, for example. But, if you haven’t paid back a sizable portion of your mortgage you probably won’t be able to borrow much. In addition, taking on a home equity loan could put an extra financial strain upon you if you hit difficult times.

The best credit scores to get credit

First things first: you don’t need an exceptional credit score to get a loan. Even if you have bad credit, there are options out there that may be suitable for your personal circumstances. However, a good credit score comes with some benefits. Imagine it as being invited into the VIP lounge of credits: you can get good interest rates, comfortable loan terms, and overall you won’t spend as much money on a loan. With bad credit, you might have to shop around a bit more to find a suitable creditor and your options could be more limited.

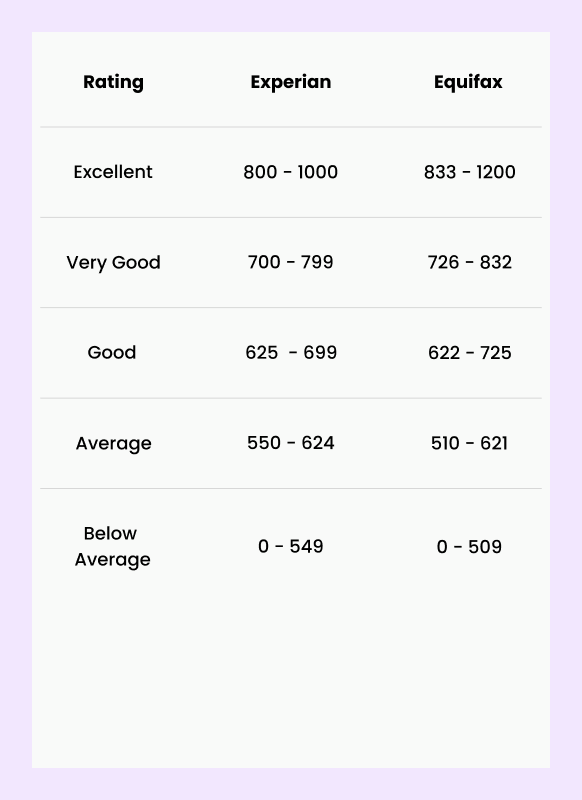

Here’s how Equifax and Experian categorise your credit scores:

Source: Equifax and Experian

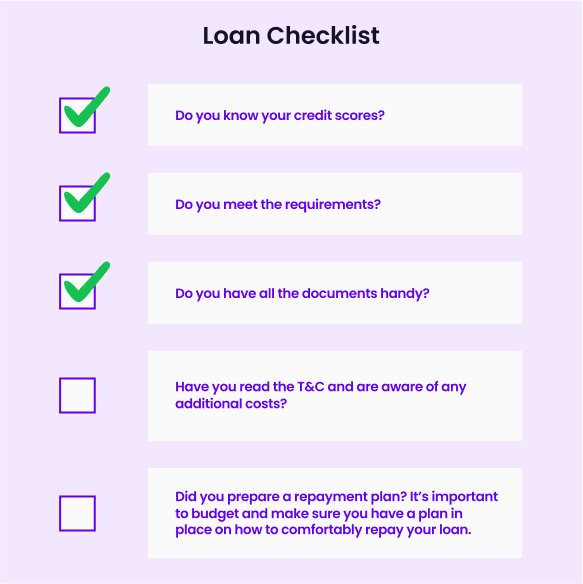

If you’re not sure what things you should consider before applying for a loan, we’ve put together this helpful loan checklist below:

Interest rate vs comparison rate

Every loan you apply for comes with interest. This is the amount of money that you pay on top of the money you are borrowing. Your interest rate is usually expressed in an annual percentage rate (APR) and will be reflected in your weekly, fortnightly or monthly repayments.

However, when comparing loans, the interest rate is not everything you should be looking at. A loan may be associated with other additional costs and fees. Examples include establishment costs and monthly account fees. That’s why you should look at the comparison rate rather than the interest rate alone when reviewing loan costs.

The comparison rate includes any additional charges and ongoing maintenance fees. Every credit provider is legally obligated to provide it and it gives you a better understanding of how much you will be paying on top of your loan.

Requirements for getting a loan

Your eligibility for a loan depends on your personal circumstances and which type of loan you’re applying for. Each credit provider has an individual application process and specific requirements they are looking for. It’s best to check their requirements thoroughly before applying for a loan to ensure you’re not wasting an application (and a credit enquiry entry) on a loan you could’ve known you wouldn’t get.

There are a number of things you could do before applying for a loan:

- Check your credit scores and know where you’re at.

Having a low credit score may cause a credit provider to reject your application. Each application will leave a mark on your credit score and could cause it to drop. To avoid bad surprises, you should check your credit scores frequently and know how they are changing. - Be mindful with your applications.

Each credit application will pull a hard request on your credit report and may harm your credit score. Other credit providers won’t be able to see if you got accepted or not. To avoid this, it could be in your best interest to compare credit providers before you apply. - Make a repayment plan.

Taking on a loan is a serious financial commitment and you want to make sure that it won’t harm your finances in the future. Therefore, you should think about your budget and how to repay your loan upfront.