Which Credit Score Matters Most?

This text can be used to describe shortly what the Credit Score Basic is used for.

In Australia, you have three credit scores – one each from the three credit reporting agencies (CRAs), also referred to as credit bureaus – Equifax, Experian and illion. Today, we’re going to explore which credit score matters most out of the three.

What is a credit score?

Let’s cover some basics first – what is a credit score? A credit score is a number that falls somewhere on a scale between 0 and 1,200. This number represents your creditworthiness, which basically means, how reliable of a borrower you are. The higher your credit score, the more reliable you are perceived to be.

Your credit score is calculated by the information contained in your credit report. Banks, non-bank lenders, credit unions and other credit providers are required to report their credit information to the CRAs in Australia. The information they report includes credit enquiries, credit accounts, defaults, repayment history and more.

Your Equifax credit score

Equifax is the largest of the three credit bureaus in Australia, with a presence around the world. Your Equifax credit score is based on the information reported to Equifax by credit providers and calculated using the company’s credit scoring algorithm.

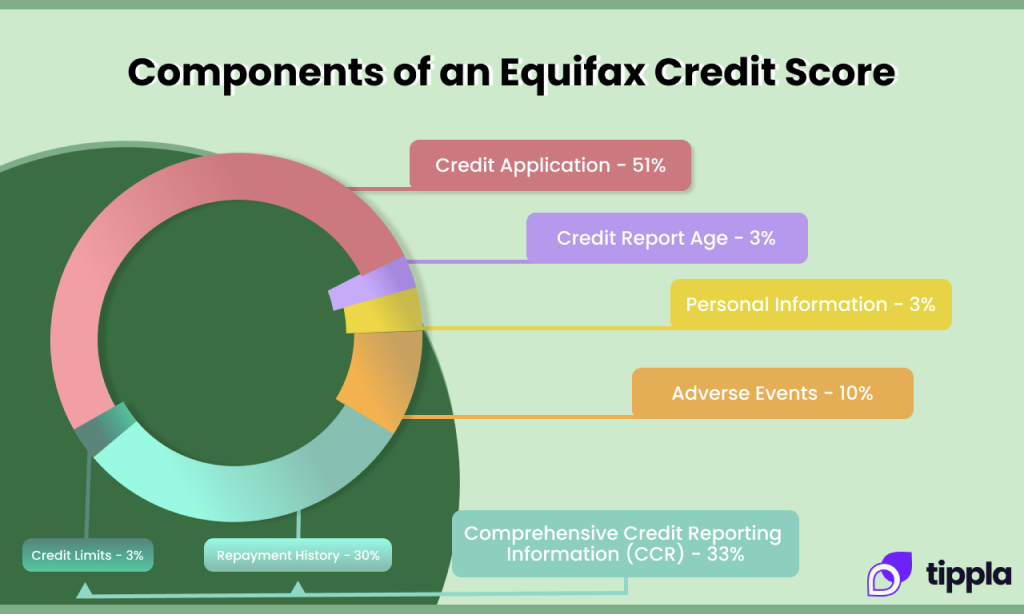

Whilst we don’t know the exact algorithm used by Equifax, the company has outlined the general factors considered in credit score calculations as follows:

- The number of accounts you have;

- The types of accounts;

- The length of your credit history;

- Your payment history.

Furthermore, the CRA has provided the following information on how they typically calculate your credit score:

Source: Equifax

Your Experian credit score

Experian is another credit bureau in Australia that calculates your credit score and report. Whilst the company is similar to Equifax, it is known for being the more data-driven out of the three credit bureaus in Australia.

Experian calculates your credit score using its own statistical algorithm based on your credit history.

As highlighted by the bureau itself: “Your Experian Credit Score is calculated applying a statistical algorithm that uses past events to predict future behaviour. Each credit bureau uses a slightly different algorithm and does not disclose in detail how this is calculated.”

Nonetheless, Experian outlines the following key attributes that are used to generate your credit score. This includes:

- Type of credit providers that have made enquiries on your report;

- The type of credit you have applied for;

- Your repayment history;

- The credit limit of each other credit products;

- Negative entries;

- The number of credit enquiries (credit applications) you have made.

Your illion credit score

illion outlines on its website that it determines the credit ratings of individuals by looking at whether you are reliable with paying your bills.

Specifically, the credit bureau states that the following events could harm your credit score:

- Not paying your bills on time, or failing to pay them at all;

- Applying for credit too often;

- If someone else defaults on a joint debt.

Why is my credit score important?

Let’s now take a look at why your credit score is important. A lot of people might have heard about their credit score, some people might even know what their credit score is, but a lot of people might not know why their credit score matters.

Your credit score and accompanying credit report is one of the key ingredients that lenders and credit providers use to determine whether to accept or reject your credit application. Whilst your credit score isn’t the only factor they consider, it is an important piece of the puzzle.

Because of this, your credit score and report can be the difference between you being accepted and rejected for credit. That’s one of the main reasons why your credit score is important.

Which credit score matters most?

Out of your three credit scores, which one matters the most? Unfortunately, it’s not such a clear-cut answer. When you apply for a loan, credit card, or another type of credit, the company you are applying to will check your credit score and credit report.

It will depend on the company as to which credit report they will check. Some companies might only check one of your credit reports and scores, however, others might check two, or even all three.

Therefore, when it comes to which credit score matters most, the simple answer is – all of them. Any of your three credit scores can be used to assess your creditworthiness. That’s why it’s important to ensure that all the information on each of your credit reports is accurate and up-to-date.

How to improve your credit score

If you have taken a look at your credit score, and you want to know how to improve it, here are a few ways you can improve your credit score.

Space out your credit applications

Did you know every time you apply for credit, it registers as a hard enquiry on your credit report? Hard enquiries harm your credit score, and they remain on your credit report for up to 5 years. This means, whenever you apply for new credit, the company you’re applying with can see your previous applications over the past 5 years.

With this in mind, if you want to limit the damage to your credit score, then you can space out your credit applications.

Don’t take on too much credit

If you have too many open credit accounts, such as multiple loans or credit cards, then it can negatively affect your credit score. Having too many credit accounts at once can make it appear like you are in financial distress, or have difficulty managing your finances. Therefore, you are perceived to be a more risky borrower.

One way to avoid this preconception is to only take out credit when you need it. This way, you could avoid having too many credit accounts open at once.

Make your repayments on time

Your repayment history is one of the factors the credit bureaus consider when calculating your credit score. Therefore, in order to improve your credit score, or maintain a good credit score, you could make sure that you make your repayments on time.

If you can demonstrate that you can effectively manage your debt by consistently meeting your repayments, this can go a long way to proving your creditworthiness.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.