Can You Get a Personal Loan with No Credit Score?

This text can be used to describe shortly what the Credit Score Basic is used for.

Are you looking for a personal loan, but you’re worried about not having a credit score? Can you even get a personal loan with no credit score? Tippla has put together this helpful guide to answer your questions.

Why does a credit score matter when applying for a personal loan?

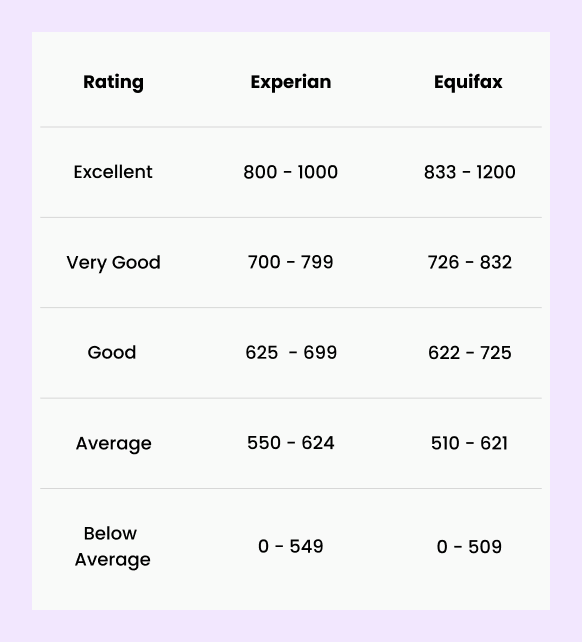

Your credit score is a number ranging from 0 – 1,200. This number represents your creditworthiness, AKA, how reliable of a borrower you are. The higher your score, the more reliable you are perceived to be. If you have a low score, then you are deemed as a higher risk.

Your credit score is viewed by credit providers, such as lenders, banks, utility companies and more, every time you apply for some kind of credit. This could be a loan, credit card, phone plan and more.

When you apply for a personal loan, your credit score is one of the many ingredients lenders and credit providers use to determine how risky of a borrower you are. Because of this, your credit score can affect your loan application.

Whilst your credit score isn’t the only factor lenders consider, it can strengthen, or if you have a below-average or no credit score, weaken your loan application. That’s why it’s a good idea to know what your credit score is, and how to improve it.

What does having no credit history mean?

If you don’t have a credit score at all, it means one of the measures lenders use to assess your application is missing. This means they have less information to make an informed decision.

If you don’t have a credit score, this could be a red flag for a lender. Because of this, you might only be offered loans with higher interest rates or your application could be rejected entirely. Therefore, having a good credit score or higher can improve your chances of being approved for a personal loan.

What do lenders look at when applying for a personal loan?

Your credit score is only one of the factors that lenders and banks use to assess your loan application. Some of the other things they also look at include your salary, spending habits, length of employment, government benefits and more.

Here are some of the minimum requirements for applying for a personal loan:

- Be 18 years or older;

- Be an Australian or New Zealand citizen, or have Australian residency or valid visa;

- Live in Australia;

- Meet the minimum income requirements;

- Not be going through bankruptcy;

- Have employment or receive a regular income;

- Have a good credit rating.

What are my options to get a personal loan with no credit score?

If you don’t have a credit score, it doesn’t mean that you can’t get a personal loan. However, it will reduce your options. Furthermore, some loan types and amounts could be completely out of your reach if you don’t have a credit score.

This means you might not be able to get the type of loan or borrow the total amount that you want because you don’t have a credit score. Nonetheless, there are still avenues you can explore to get a personal loan.

Here are some of the options available for you to get a personal loan with no credit score.

No credit check personal loans

In Australia, you can get a personal loan without the lender performing a credit check. This could be an option if you don’t have a credit history However, no credit check personal loans are very difficult to find, and the options are limited.

For no credit check personal loans instead of looking at your credit history, lenders will instead look at your income, employment status, existing debts and other criteria when looking at your loan application.

Because these loans are riskier for the lender, no credit check personal loans will often come with higher interest rates and fees.

Secured personal loans

When it comes to personal loans, there are two main types – unsecured and secured personal loans. A secured personal loan is a loan guaranteed by an asset, such as a car, motorbike, or something similar. The asset acts as security, which is where the name “secured” personal loans comes from. If you default on your loan, then your asset could be repossessed as a way to cover your repayments.

Because of the extra security, secured personal loans are generally easier to obtain from a reputable lender. They typically come with lower interest rates and fees as there is less risk for the lender.

If you don’t have a credit score, taking on a secured personal loan could be an option for you. However, just because secured personal loans on average can have lower interest rates, if you have no credit history at all, you still might be charged higher interest rates than someone with a good credit score, regardless of whether the loan is secured or not.

How to build a credit history from scratch

Whilst you can get a personal loan without a credit score, it’s not necessarily your best option. So how can you build a credit history from scratch? Here are a few things you can do.

Open a bank account

If you’re trying to build your credit history, a good starting point is to open a bank account for yourself. Having a bank account can help you apply for credit later down the track. It is also a good way of tracking your spending, which is something that lenders like to see when you apply for a loan.

Although opening a bank account won’t directly impact your credit score, it could be a good starting point.

Add your name to your utilities

If you live out of home and have utilities, such as water, gas or electricity, then it could be a good time to add your name to your utility bills. Your utilities are a form of credit. If your name is on the account, then each payment you make could go towards building your credit score.

Apply for a credit card

Another way you can build your credit history is by applying for a credit card. Whilst your choices are more limited if you don’t have a credit score, there are still options out there.

For example, you could get a student credit card or a secured credit card. Alternatively, if you have had a bank account with a bank for a while, they might be willing to provide you with a credit card.

Proactively provide information to credit bureaus

Credit bureaus base your credit reports and scores on the information provided to them by the companies you have credit with. If you don’t have any credit, then the bureaus likely won’t have any of your information.

One way you can change this is by providing your information directly to the credit bureaus. You could, for example, send them a document to prove your identity and address. If you move house, it’s important that you update your address, so you don’t end up with multiple files with different credit information.

How long will it take to build a credit history?

Unfortunately, you can’t build a good credit history overnight. As the saying goes, good things take time. If you don’t have any credit history, the good thing is that you don’t have to wait for negative entries to be removed from your credit report. However, it will still take time for your good credit behaviour to reflect on your credit score.

According to Experian, one of Australia’s largest credit bureaus, it takes between 3 and 6 months until they have collected enough data to calculate a score for you.

What’s the best credit score for a personal loan?

Whilst there is no “perfect” credit score, if you are wanting to apply for a personal loan, you should be aiming for a credit score that is either good or higher. The better your credit score, the more options you will have.

Source: Equifax and Experian

Bad credit score? Here’s how to improve your credit score

What if you have a below-average credit score? Similar to having no credit score at all, this can limit your finance options, and you will likely be offered loans with higher interest rates, fees and less desirable lending conditions.

Here are 3 easy ways you can improve your credit score.

Space out your credit applications

When you apply for a loan, the company you apply with will check your credit report. This is known as a hard enquiry and will lower your credit score. Because of this, it is a good idea to limit your credit applications to protect your credit score.

You can do your research, compare your options, and apply for loans where you meet all the criteria. This could limit the number of applications you need to make and protect your credit score.

Make your repayments on time

Your repayment history contributes to your credit score. If you miss your credit repayments or default on one of your bills, then this could appear on your credit report and drag down your credit score. With this in mind, it’s important to ensure you always make your repayments on time.

How can you do this? You could set up automatic payments, budget so you have enough money in your account to afford the repayments, and don’t take on more debt than you can afford to repay.

Check your credit reports frequently

Frequently checking our credit reports can allow you to identify a mistake on your credit report quickly. 1 in 5 credit reports has some kind of mistake on it. Sometimes this mistake can be harming your credit score.

If you are frequently checking your credit report, you will be able to identify mistakes early on and have them removed. This can protect your credit score from being dragged down by inaccurate information.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.